Wealth Management

At illumiFI Wealth, we view investing as more than chasing returns — it’s about stewarding resources with purpose. Our wealth management approach connects your investments to your values, priorities, and long-term goals so your portfolio becomes a tool for the life you’re building, not a distraction from it.

We don’t believe in one-size-fits-all portfolios or cookie-cutter models. Instead, we design evidence-based, tax-aware strategies tailored to your goals, time horizon, and comfort with risk. By integrating behavioral finance with disciplined investment principles, we help you stay focused on what you can control — allocation, costs, taxes, and your long-term vision.

Our role is to simplify complexity and bring clarity to your entire financial picture. Whether you’re accumulating wealth, preparing for retirement, or managing generational assets, we serve as your ongoing partner — helping you make confident, informed decisions through every market environment.

Our Investment Philosophy

Strategic Asset Allocation

We build portfolios rooted in diversification and balance — designed to capture market growth while managing risk across time horizons and economic cycles.

Modern Portfolio Theory

We apply academic research and quantitative analysis to construct portfolios that maximize expected return for a given level of risk, ensuring your investments work efficiently toward your goals.

Evidence-Based

Our investment decisions are grounded in decades of market and behavioral research, not short-term speculation or media noise.

Diversification

Your portfolio spans numerous asset classes, regions, and sectors to reduce risk and participate in global growth opportunities.

Cost-Conscious

We minimize unnecessary fees and inefficiencies so more of your return stays compounding toward your long-term vision.

Tax-Aware

We help you invest smarter by optimizing asset location, implementing tax-loss harvesting, and integrating charitable and retirement tax strategies.

Values-Aligned

For clients who wish to reflect their beliefs or social priorities in their portfolio, we offer faith-based and socially responsible investment options without compromising discipline or diversification.What’s Included in Wealth Management

What’s Included in Wealth Management:

Portfolio Construction & Monitoring – Custom asset allocation aligned with your goals, risk profile, and time horizon.

Tax Optimization – Strategies such as tax-efficient rebalancing, asset location, and charitable giving integration.

Ongoing Rebalancing & Adjustments – Portfolios are monitored regularly and adjusted as your life or market conditions change.

Retirement Income Planning – Transition from accumulation to distribution with tax-smart withdrawal strategies.

Charitable Giving Integration – Maximize impact and minimize taxes through donor-advised funds, appreciated stock gifts, and legacy planning.

Behavioral Coaching – Guidance to help you stay disciplined during market volatility and make decisions grounded in purpose, not fear.

Fee Structure

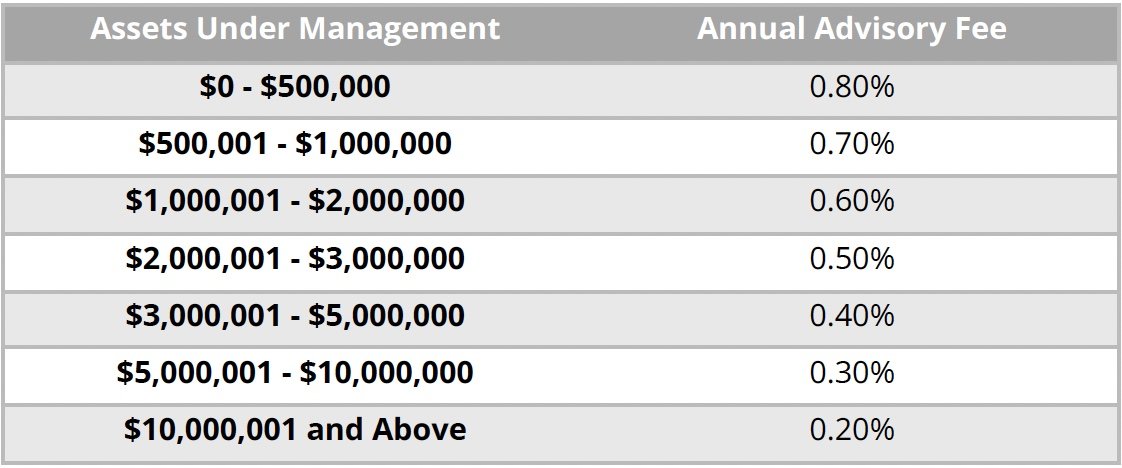

The fee is based on a percentage of assets under management and is negotiable.

For Clients with more than $1,000,000 in assets under management, ongoing financial planning is included at no additional cost. We will not include your unmanaged or static assets when calculating our advisory fee.